Citizens Trust Bank is among the largest Black-owned financial institutions in the country. For more than a century, it has provided critical financial services to Black-owned businesses and institutions in Atlanta and beyond.

On August 16, 1921, Citizens Trust Bank opened on Auburn Avenue in Atlanta. Its Trust Bank founder, African American businessman Heman Perry, served as the first chairman of the board, and Henry C. Dugas was Citizens Trust’s first president. An instance of racial discrimination inspired the creation of the bank: Perry attempted to be fitted for a pair of socks at a white-owned store and was refused. So that Black businessmen could own and operate businesses independently of white-owned financial institutions, Perry and four other partners (collectively known as the “Fervent Five”) formed Citizens Trust Bank.

Courtesy of Citizens Trust Bank

The bank officially reorganized in 1927 with new articles of incorporation and bylaws. Clayton R. Yates was elected acting chairman of the board and Lorimer D. Milton was elected cashier-treasurer. A decade later, in 1938, Milton would become Citizens Trust’s president and chief executive officer (CEO). During this early period, the bank supported numerous community projects, including fundraising to restore Big Bethel Church following a fire.

On March 5, 1933, the day after being sworn into office, U.S. president Franklin D. Roosevelt declared a “bank holiday.” For four days, the nation’s banks remained closed, halting all financial transactions in order to allow the new administration time to address the national banking crisis. Because of its sound operation, Citizens Trust was one of the first banks to reopen. Shortly thereafter, Citizens Trust became the first Black–owned bank to become a member of the Federal Deposit Insurance Corporation. In 1948 Citizens Trust became the first Black–owned bank to join the Federal Reserve Bank.

In the 1950s Citizens Trust began investing in the development of housing subdivisions throughout southwest Atlanta, creating neighborhoods that would become some of the most affluent residential areas for Black Americans in the country. After the development of the Hunter Road project using a special program of the Federal Housing Administration, the bank developed the Mozley Park subdivision, for which white banks would not provide mortgages. In addition Citizens Trust provided financing for the Morris Brown subdivision and the Bankhead and Hightower communities. The bank was also instrumental in providing financing for African Americans purchasing homes in white communities. During this time Citizens Trust opened its first branch office, the Westside Branch.

Courtesy of Citizens Trust Bank

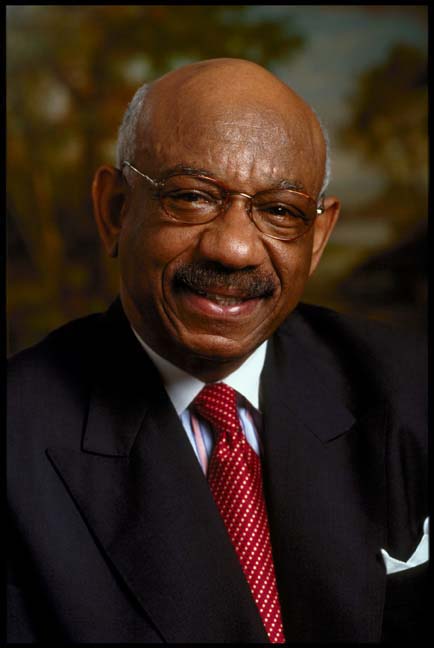

In the mid-1960s Milton and his management team recognized the need for a new headquarters and planned a new facility at 75 Piedmont Avenue. After completion of the building, Milton retired. Among the bank’s first employees, Milton had guided the institution through the Great Depression, Word War II, and racial segregation and helped to increase its total assets from $300,000 to more than $26 million. In 1971 Charles Reynolds, the bank’s executive vice president, succeeded Milton as president, and I. Owen Funderburg, president and CEO of Gateway National Bank in St. Louis, Missouri, became CEO and president in 1975.

Owen Funderburg, president and CEO of Gateway National Bank in St. Louis, Missouri, became CEO and president in 1975. Under Funderburg’s leadership Citizens Trust expanded its role in the National Bankers Association, the trade group for the nation’s minority-owned commercial banks. By 1985 Citizens Trust had increased its size to $96 million and was named bank of the year by Black Enterprise magazine. By 1990 the bank was solidly over $100 million in size and often challenged Industrial Bank of Washington in Washington, D.C., and Seaway National Bank in Chicago, Illinois, as the largest Black-owned commercial bank in the country. Funderburg retired in 1992, after seventeen years with Citizens Trust.

In 1992 William L. Gibbs was named Citizens Trust’s new president and CEO. Under Gibbs, Citizens Trust opened new in-store branch offices in Cub Foods grocery stores and adopted a new motto: “Strength through Progress.”

In July 1997 Gibbs resigned from Citizens Trust, and a year later the bank merged with First Southern Bank First Southern president James E. Young would assume the presidency of the new bank, and Citizens Trust ended February 1998 with approximately $191 million in total assets.

Courtesy of Citizens Trust Bank

The bank continued to expand. In June 1998 Citizens Trust, solicited the partnership of three other minority-owned banks and loaned the historic Ebenezer Baptist Church $5.5 million to finance the construction of a new sanctuary. In the spring of 1999, the common stock of Citizens Trust became available for public trading. Additionally, Citizens Trust became the first and only Black–owned bank in the nation to become part of the Small Business Administration’s Preferred Lender Program.

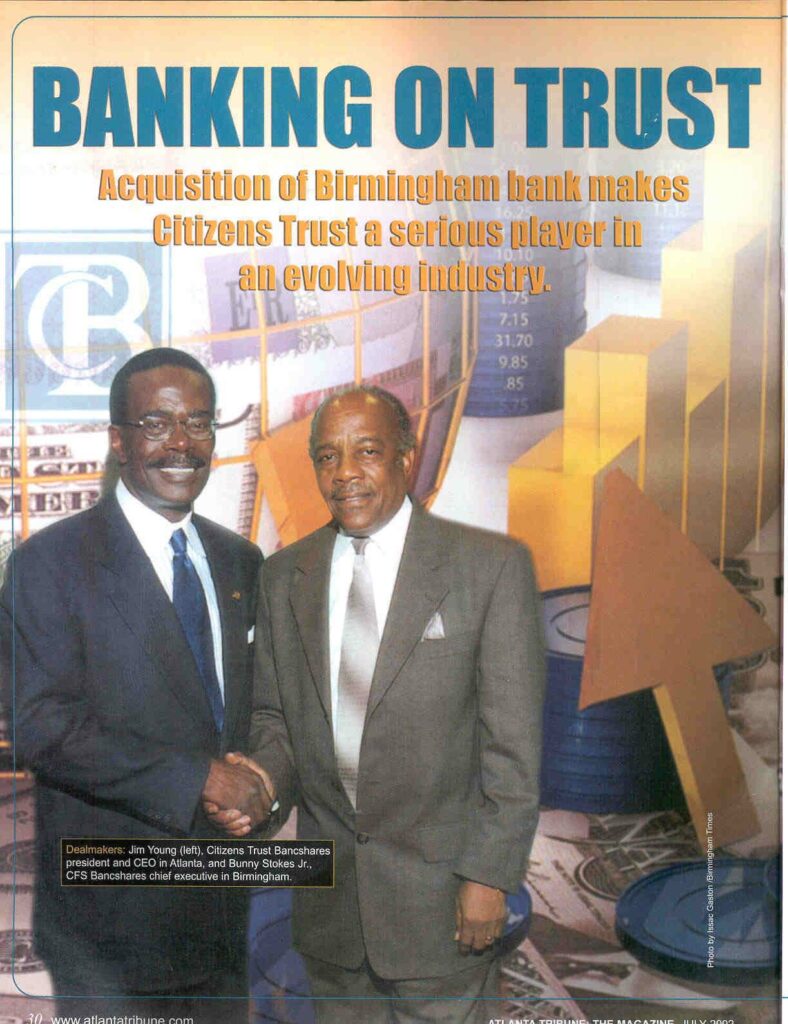

On 2000, Citizens Trust acquired Atlanta’s Mutual Federal Savings Bank, increasing assets by some $30 million to nearly $250 million. Just three years later, on February 28, 2003, Citizens Trust acquired Citizens Federal Savings Bank in Birmingham, Alabama, which had been founded in 1957 by African American businessman A. G. Gaston. The assets of Citizens Trust were now worth nearly $400 million.

Courtesy of Citizens Trust Bank

The bank remained relatively strong during the 2008 financial crisis. And, in 2009, Citizens Trust acquired the Peoples Bank branch in Lithonia, which increased the bank’s presence within the state. In 2012 Cynthia N. Day was named president and CEO, becoming the first woman to hold either position. In 2021 Citizens Trust welcomed a multi-million dollar capital investment from JP Morgan Chase.

For over a century, Citizens Trust Banks has served the Black community, and the bank continues to do so by supporting minority-owned businesses and providing financial services to under-served communities.